Perhaps you’ve noticed that I’ve been on a death kick lately. And given that this is tax season, it seemed a natural segue. As I—and many others—have often said, everything is fodder for writers.

Of course there is the obvious: the frustration of the forms, last minute scramble, missing documents, taxes due and no money to pay them, filing for extensions, and so forth. Being obvious doesn’t preclude rich story possibilities.

Then there are variations of the theme: your character finally wedged a CPA appointment into a jammed schedule only to discover that said CPA has moved, s/he can’t find the office, misses the appointment, etc.

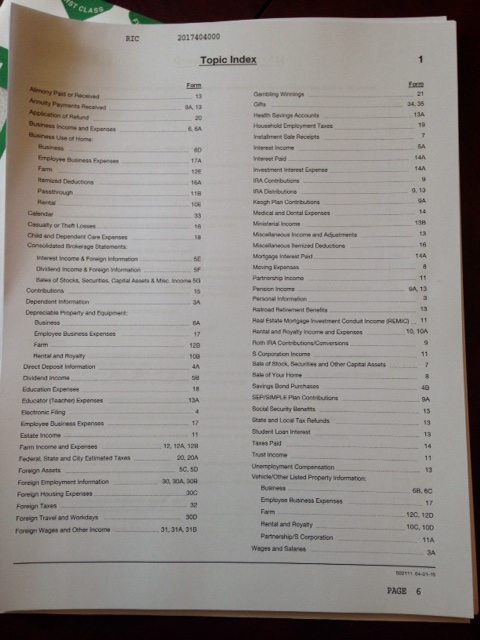

But dig deeper. Virtually every item on the topic index is rife with writing possibilities. These may or may not be directly related to the taxes due, but dealing with them at tax time could well trigger the strong emotions that fuel great stories. Here is a select list:

- alimony paid or received (or not)—and associated hostility

- business use of home—and the strain it puts on family

- casualty or theft loss—and the aftermath of being a victim of crime

- child and dependent care expenses—meeting them, but also finding such services in the first place

- contributions—a willing tithe to church, or possibly being pressured to support your alma mater

- education expenses—and doubts about whether the degree is worth it

- foreign assets, expenses, taxes, and income—and what to do about off-shore accounts and tax shelters

- gambling winnings (or losses)—and whether to join Gamblers Anonymous

- gifts—and why they were given

- medical and dental expenses—and the trauma of diagnosis, surgery, recovery (or not)

- miscellaneous income and adjustments (They really expect people to report illegal income??)

- mortgage or education loan interest paid—and the continuing burden from years ago

- moving expenses—whether the move was up or down, willing or forced

- sale of home, stock, or other capital assets—and why the sale? Was the market down at the time or up?

- unemployment compensation—whether it was enough, whether it ended too soon, whether filing for it was humiliating

TAKEAWAY FOR WRITERS

As you do your taxes this year, consider the good and the bad—and then think how you could make it even better or worse in fiction!