I suppose there might be people out there who can file their annual tax returns stress-free. Congratulations! For the rest of us, condolences!

Money and Stress

“Money is a major source of stress on people, and what tax season does is shine a great big spotlight on the issue,” Michael McKee, a Cleveland Clinic psychologist and president of the U.S. branch of the International Stress Management Association, told WebMD. “Money takes center stage at tax time, even if you might have been able to push it to the wings the rest of the year.”

A 2004 survey sponsored by the American Psychological Association found that nearly three-quarters of Americans cited money as a significant source of stress. Money is also consistently among the top causes of marital contention, says Olivia Mellan, a psychotherapist and financial self-help author based in Washington, D.C.

Heightened Tax Stress

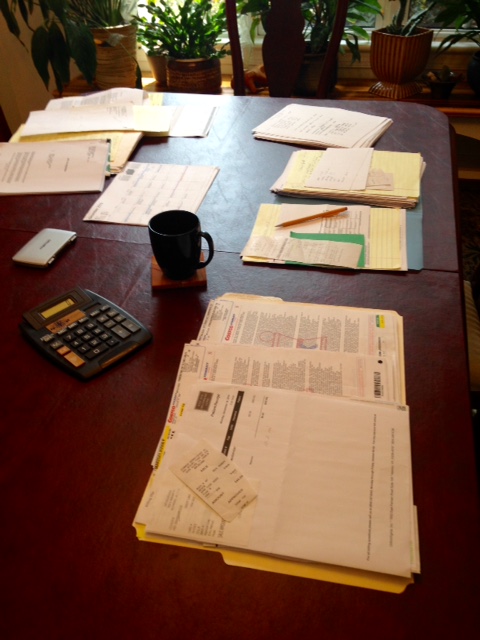

And nothing focuses us on money like tax time. Anyone can face the stress of having money due and too little money on hand. For those who itemize, there are additional sources of stress:

- The frustration of the forms’ language

- Finding time to do the work

- Filing for an extension

- Missing documents

- (This is a biggie. It could be anything, but it’s often receipts. I won’t go into the time my husband inadvertently threw away all of our 1099s.)

Then there are miscellaneous stresses:

- You finally wedged a CPA appointment into a jammed schedule only to discover that said CPA has moved, you can’t find the office, miss the appointment, etc.

- Your CPA retired last summer

- A bigger accounting firm absorbed your old one and now communications are via a headquarters in South Carolina (or wherever)

Sources of Financial Stress

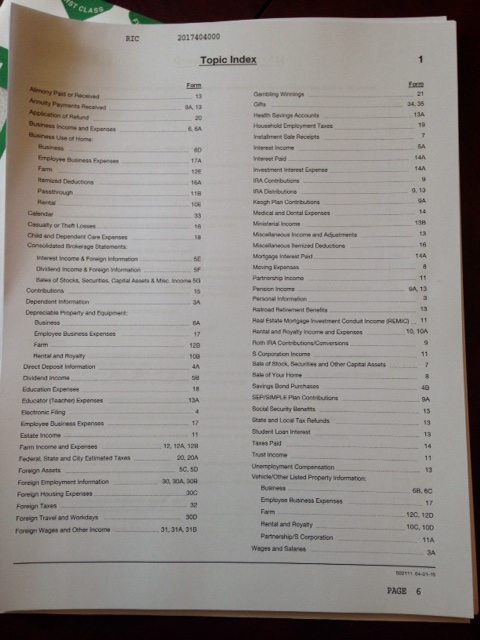

But virtually every item on the topic index is rife with sources of stress. These may or may not be directly related to the taxes due, but dealing with them at tax time could well trigger strong emotions. Here is a select list:

- Alimony paid or received (or not)

- …and associated hostility

- Business use of home

- …and the strain it puts on family

- Casualty or theft loss

- …and the aftermath of being a victim of crime

- Child and dependent care expenses

- …meeting them, but also finding such services in the first place, and possibly the precariousness of arrangements

- Contributions

- …a willing tithe to church, or possibly being pressured to support your alma mater

- Education expenses

- …and doubts about whether the degree is worth it

- Foreign assets, expenses, taxes, and income

- …and what to do about off-shore accounts and tax shelters, should you be one of those people

- Gambling winnings (or losses)

- …and whether to join Gamblers Anonymous

- Gifts

- …to whom and what and whether they were freely given

- Medical and dental expenses

- …and the trauma of diagnosis, surgery, recovery (or not)

- Miscellaneous income and adjustments

- (They really expect people to report illegal income??)

- Mortgage or education loan interest paid

- …and the continuing burden from years ago

- Moving expenses

- …and whether the move was up or down, willing or forced

- Sale of home, stock, or other capital assets

- …and why the sale? Was the market down at the time or up?

- Unemployment compensation

- …and whether it was enough, whether it ended too soon, whether filing for it was humiliating

- Sale of home, stock, or other capital assets

- …and why the sale? Was the market down at the time or up?

- Unemployment compensation

- …and whether it was enough, whether it ended too soon, whether filing for it was humiliating

If you are filing a joint return, remember (and remind your spouse if necessary) not to displace anger/frustration rooted in the process.

Other Sources of Tax Stress

Then, too, sometimes there are ongoing issues about money. For example, if one partner is a spender while the other partner is a saver and a worrier. This can result is resentment at tax time, when a couple may examine how their habits are affecting their lives and marriage.

“Of course, we all bring our individual emotional baggage to tax preparation. Fear of the government also emerges at tax time. Some clients of financial counselor Karen McCall are so afraid of the IRS that they won’t take even the most innocuous deduction. “They’re paralyzed because the IRS is an authority figure, and if they have unresolved issues around authority figures in their lives, that can cause a lot of fear.”

Sometimes, that fear of filing taxes stems from is understandable. As Michael McKee says, people who have been through audits can suffer from post traumatic stress syndrome during tax season for years afterward.

Avoiding Tax Stress

You may not be able to avoid all stress at tax time, but consider ways to lessen it. Mellan and McCall offered these tips in a WebMD article on coping with tax stress.

- To avoid last-minute stress, file early and break up the job into little pieces, Mellan suggests. Do your taxes while listening to music or whatever else makes you feel relaxed.

- For filers with math anxiety, Mellan recommends hiring a preparer or investing in tax software. Tax software typically collects information through an “interview” and the computer does all the calculations.

- For some people, the IRS offers free online tax filing software.

- Fractious couples should strategize on ways to avoid chronic money fights, Mellan says. For example, try communicating financial information through notes or other modes that won’t carry an accusatory tone.

- McCall suggests channeling tax-time stress into a resolution to track your finances more carefully. Better money management is the best way to avoid unpleasant surprises each year, she says.

- Finally, if you’re feeling overwhelmed, you can turn to your buddies at the IRS. Options include filing an extension or setting up an installment plan for tax payment. For more details, visit the IRS website at www.irs.gov.

Bottom Line: Tax time is stress time. You’ll just have to deal, starting with recognizing the danger zones and ameliorating as best you can.