CONSIDER THE DOWNSIDE OF CHRISTMAS.

Part of the downside of Christmas is this myth that everything and everyone is merry and bright, and if you aren’t, you must be a Scrooge. Or a Grinch. Or Burgemeister Meister Burgher. Indeed, much of what follows also applies to Hanukkah, Kwanzaa, Ōmisoka, and other holidays too numerous to mention. Almost everyone (every character?) suffers one or more of these downsides of typical celebrations.

Exposure Fatigue

- Going into a store in October and see “decorations” for Halloween, Thanksgiving, AND Christmas

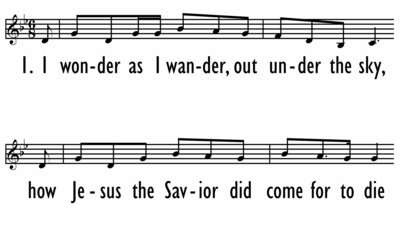

- Christmas music that begins to be played everywhere before Thanksgiving

- Christmas music gets old fast, particularly for people working in retail

- Commercials touting the “perfect” gift

- The pervasiveness of sappy Christmas movies (and over-exposure to the good ones, such as “It’s a Wonderful Life” and “Miracle on 34th Street”)

Physical Fatigue

- Decorating

- Food preparation

- Package wrapping and/or mailing

- Attending celebratory events, especially navigating office/work place parties

- Hassles of travel (insane boarding lines, delayed flights, driving clogged highways)

- Making gifts or cards by hand

- Shopping for presents

- Finding a mall parking space 2 miles from the shops

- Tracking down the right present for the right person

Weather

- Living in a warm place, one laments the lack of snow

- Living in a cold climate, one laments cold and snow that keep people inside

- Ice storms that keep one from attending/hosting a holiday event

- Combination of extra traffic, stressed drivers, and wintry weather can make every drive a terrifying experience

Family Stresses

- Feeling compelled to see family you’d rather not

- Spending time with the family of one’s significant other can be even worse

- Conflicts between/among guests

- Pretending to like presents you don’t

- Taking awkward photos

- Kids demands for presents and apply pressure in in terms of values, money, and parenting

- Waiting in endless lines for kids to visit Santa at the mall

- Bad situations can worsen, and marriages are strained

- Recently divorced parents navigating custody arrangements

- Divorce lawyers have their busiest month in January

Financial Strains

- Feeling pressed to give a gift of equivalent value, even when the “gift lists” for giver and recipient aren’t the same

- Dealing with a year when one’s gift-giving must be cut/downsized in number and/or expense and it will be obvious

- Higher electric bill for huge outdoor displays

- Travel, tickets, decorations, food, etc., can drain bank accounts and max out credit cards even without buying gifts

Physical Health

- Emergency room visits are up 5-12% around Christmas

- Slips and falls on icy walkways or while putting up decorations

- Sharp object injuries from unfamiliar cooking utensils, new toys, assembling gifts

- Falls from a height

- Workplace accidents

- Abdominal discomfort from overeating

- Psychiatric disorders exacerbated by stress and crowds

- Poisonings

- Incorrectly prepared food

- Overconsumption of alcohol

- Disruption of healthy patterns

- Abandoning diets or eating irregularly

- Loss of sleep

- Failure to follow doctor’s instructions for treatment and/or medication

- A typical Christmas meal is likely to be two-to-three times the recommended daily calorie count

- Indulging in meals, cakes, pies, chocolates, or whatever sweets

- Cookies, biscuits, candy, homemade treats brought in to the workplace or shared by shops for the entire season

- Stress levels are almost certain to be higher than usual

- Stress contributes to heart disease, stroke, and cancer

- Stress leading to immune system breakdowns, leading to colds, for example

- Mingling with more people exposes them to more infections, especially flu and flu-like symptoms

- Falls, cuts, and burns result in tens of thousand of visits to the ER

- Alcohol consumption resulting in alcohol poisoning, broken bones from skips and fall, car and home accidents, etc.

- Domestic violence is up about one-third compared to an average day

An ambulance driver explained it to me this way:

“It’s like everyone’s on a hurt-yourself schedule, same every year. Early morning starts with the drunk drivers going home from parties, sometimes the homeless with hypothermia, depends on the weather. Then the kids get up way too early and open their presents and start hitting each other with them or falling off anything with wheels and breaking any bone you can think of.

“After that, you get a mix of cooking accidents and alcohol poisonings through the afternoon. Eventually, people hit their limit with family, have too much to drink, and start beating on each other. That’s also about the time ‘lonely hearts’ start calling us, asking to go to the hospital just because they have no place else to go and they don’t want to be alone.

“People eat too much at dinner and get the ‘too-much-macaroni sweats.’ They get heartburn and think they’re having a heart attack. We get more alcohol calls, either people fighting or passing out.

“And then everyone heads home, driving drunk. Better hope your tree doesn’t catch on fire. Happy Holidays.”

Mental Health

- There is a MYTH that suicides peak around Christmas – they actually peak in spring

- That said, it is breakup season

- The peak breakup time is the two weeks before Christmas

- Overall, holiday depression is a real thing

- Family conflicts

- Financial woes

- Expectations of perfection

- Singles watching couples get all mushy

- Loneliness is highlighted, especially for older people who live alone and have no one available with whom to celebrate

- People 65 and older are twice as likely to spend Christmas alone, compared to younger people

- The loss of a family member—previous or recent—is especially painful

- Being/fearing being left out of desirable events

- Mistletoe invites unwanted advances

- People with birthdays anywhere near Christmas often find the events conflated

- Dealing with someone who has problems, like alcoholism or domestic violence

- Wishing to skip Christmas because of other events in one’s life

- Accessing helpful services that normally help one cope can be more difficult

- Finding other religious festivals or holidays fade in comparison to Christmas

- Overall, people are more likely to experience anxiety, sleep disturbances, headaches, loss of appetite, and poor concentration

- Call rates to help hotlines spike on Christmas Eve

Environmental Downside

- Massive amounts of trash going to landfills

- Decorations

- Single-use wrapping paper

- Food waste

- Imported foods enlarging your carbon footprint

- Energy consumption

- Traveling burning fossil fuels

- Turning up the heat

- Electric lights inside and outside

The End

- Taking down/storing items for next year

- Missing the buzz and activity

- Realizing that nothing can be done about many things now regretted

Bottom line: These are all for typical Christmases. Consider which might be eased and which might be exacerbated in the year of COVID?